Expect a more cautious approach to due diligence from both buyers and W&I insurance providers following such a quick and unprecedented shift (of ‘once in a lifetime’ proportions) in the way almost all businesses are required to operate. They will want to understand how the target responded to this challenge, how it has adapted to its particular version of the new normal and how well placed it is to withstand future large-scale upheavals.

What will be under the magnifying glass?

Key areas that may see heightened scrutiny in legal due diligence are likely to include:

Material contracts: how watertight are the business’ contracts with its customers and suppliers – are there any provisions that could allow counterparties to terminate by reason of the pandemic (e.g. an inability to fulfil the contract or force majeure)? Are any customers or suppliers facing a risk of insolvency or large-scale disruption?

Health and safety: how has the business managed employee safety in line with government guidelines? Does the business have a clear strategy around a full or partial return to work?

IT systems: is business continuity feasible through remote working? If so, how has the business’ IT infrastructure coped with new demands?

Financial support: has the business received any government support during the pandemic, such as the Coronavirus Large Business Interruption Loan Scheme, or through the furloughing of employees? How will the business transition away from such support? Has the business complied with the requirements of the relevant scheme?

Tax: has the business deferred any tax payments? Has the business considered the effect of remote working on which country it is tax resident in?

Mitigation: what steps has the business taken to preserve cash? Has it undertaken any restructuring or made any redundancies? What further steps could the business take should we face a second wave?

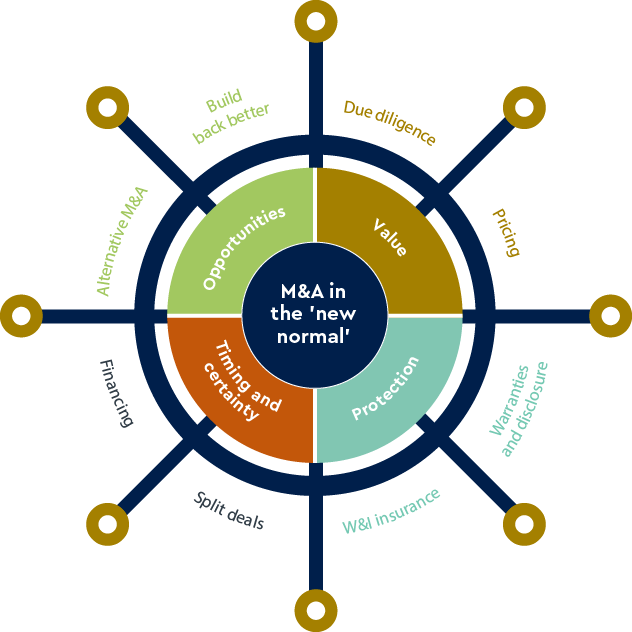

A 360° view on diligence

Buyers and insurers are increasingly likely to require a 360°, risk-based approach to due diligence to make sure that the impact of the pandemic, and how well the target has re-aligned itself for the future, is fully understood. On W&I backed deals, this will be essential if wide-scale exclusions are to be avoided. Providers of due diligence (e.g. financial, operational and legal) will need to collaborate to ensure key risks are assessed from all angles.